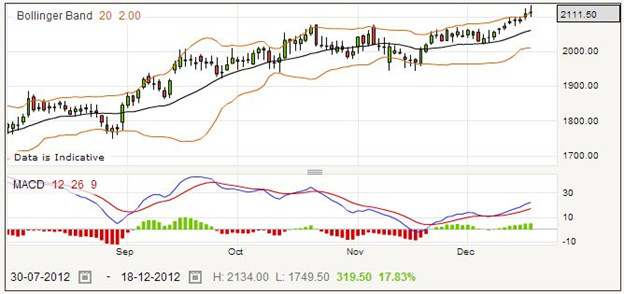

The AVEVA Group is one of the few companies with a palindromic name. This name was picked in 2001, a change to the previous name of CADCentre, which is slightly more descriptive of the work involved. You can see a variety of up-and-down trends in the daily chart below, but with fairly short candlesticks this is one of the more stable companies on which you can enjoy spread betting.

The company was founded in 1967 in Cambridge, and started as a government-funded Research Institute established by the now-defunct Ministry of Technology. The aim was to develop computer aided design (CAD) techniques and promote them to British industry. CAD was in its infancy, and the company was a pioneer in the field.

The company became private in 1983, and then underwent a management buyout in 1994. It was offered on the London Stock Exchange in 1996, prior to the change of name in 2001.

The products that the company specializes in are mainly used in process plants and power industries. Apart from design processes, the software covers information management and asset information, some of which can be associated with the visual representations. The applications include the oil and gas sector, marine engineering, and others such as mining. In addition, AVEVA customizes software for specialist tasks.

While there was some sideways movement of the price in 2011, the stock is on a growth path and is already well ahead of what was its peak value (1640) before the global economic crisis knocked it down to around 600. The MACD has provided some clear signals in the past, although the short trends make it difficult to pick good trades on this time scale. If you are interested in spread betting on this company, it may be worth looking at other timescales to see if clearer trends are available.

AVEVA Group Rolling Daily: How to Spread Bet on AVEVA Group Shares?

AVEVA Group seem to be making good progress, and if your technical analysis shows that the price will be going up, you may want to place a long spread bet on these shares. The current rolling daily price is 2105 – 2115. Perhaps you decide to place a wager of £8 per point on the buying price 2115.

Say for the sake of example that the price goes up, as you wish, and you close your bet when the quote is 2173 – 2183. That means you have gained 2173 minus 2115 points. This works out to 58 points, which for a stake of £8 is a profit of £464.

Now consider the alternative, that your spreadbet does not win and that you have to close your bet for a loss. Perhaps the price went down to 2064 – 2074. That means your bet closes at the selling price of 2064. 2115 less 2064 is 51 points. Your stake was £8 per point, which means that you have lost £408.

When you place a rolling daily spread bet, your spread betting provider will automatically rollover your bet to the next day each evening. This is because one of the rules concerning bets is that they have a set expiration date and time, therefore your daily bets expire each day. Your broker may charge a little bit each time the bet is rolled over, but unless you are keeping the bet open for weeks or months, this usually will not amount to much.

Many spread traders use the stop loss order to keep an eye on the prices for them, and close out losing trades before they move too far. In this case a stop loss order might have closed your spread bet at 2078 – 2088. With an opening price of 2115 and a closing price of 2078, you would have lost 37 points. Multiplying this by your stake of £8, your loss would have been £296.

AVEVA Group Quarterly Futures

For a slightly longer term look at the market, you may choose to use a futures based spreadbet, as the expiration is not for several months. Usually there is a wider spread, which means a greater fee for the spread betting provider, which you must balance against the rolling daily charges to see which may work out better for you.

Say you place a far quarter long futures bet on AVEVA, for which the current quote is 2120 – 2132. You may choose to stake £4.50 per point. Perhaps the price will go up to 2222 – 2234, and you will close the bet to collect your winnings. This time the starting price is 2132, and the closing price of your bet is 2222. That means you have gained 90 points on your winning bet. For a stake of £4.50 per point, that amounts to £405.

On the other hand, the price could go down and you may have to close the trade for a loss. Say the price went down to 2066 – 2078. The opening price remains the same, at 2132, but this time the bet closed at 2066, giving you a loss of 66 points. Multiplying 66 times £4.50, you find that you would have lost £297.

Even though this is a futures style bet, it is important to note that you can close it at any time, even the next day, if you choose to collect your profits or if you need to cut your losses. If you placed a stop loss order on this bet, you might find that your losses would be less as the spread bet would be closed as soon as a certain price level that you set was reached. Perhaps it would close at a price of 2086 – 2098. Taking 2086 away from the starting price of 2132, this time you have lost 46 points. 46 times your stake amounts to a loss of £207.