Ophir Energy is a recent addition to the London Stock Exchange, being first listed in the middle of 2011. It is an oil and gas exploration company started in 2004, and specializing in exploration in Africa. As with many energy companies, there are good opportunities for spread betting on the volatility of this stock.

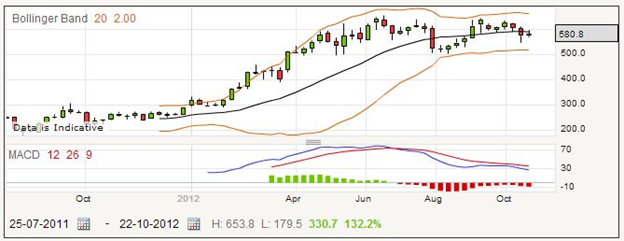

This chart shows the full extent of trading on Ophir Energy. You can see that after an initial period between 200 and 300, the stock took off to approximately twice the value. However, it is early days, and it has to be seen whether this boost in value is justified or the result of over enthusiasm. Certainly, the MACD is open to the latter suggestion.

Apart from drilling on land, Ophir has become interested in deep sea drilling, having found natural gas reserves off the coast of Equatorial Guinea. The plans are to install a liquefied natural gas plant on shore. This would double the capacity which is currently available from the state owned company operating there. The decision on whether to go ahead is expected in 2014, which would put the LNG online in about 2017.

At this early stage, Ophir is an exploration company, but has had good success in finding energy resources underground. The value of the shares depends on investors’ views of future value, as exploration companies typically do not make any money until they get to the production stage. The price typically reflects the ebb and flow of enthusiasm around the announcements of discoveries.

Another possible course for a small company such as this is as a target for merger and acquisition by a larger established energy corporation, and such action can have marked effect on share price. Many established competitors would seek to take over the company on the basis of proven reserves.

Ophir Energy Rolling Daily: How to Spread Bet on Ophir Energy shares?

Ophir Energy is a young energy exploration company, and can be expected to have a volatile price. If you are spread betting on it you need to take particular care to protect yourself against losses. The current price for a rolling daily bet is 579.5 – 582.5. Suppose you are bearish on its prospects in the near-term, you might choose to place a short bet for £5 per point at the selling price of 579.5.

For the sake of example, assume that the price drops to 456.9 – 459.9, and you decide to close your bet and collect your winnings. The opening price was 579.5, and the closing price is 459.9. That means your short bet has made 119.6 points. Multiplying this by your stake of £5 per point, your total winnings work out to £598.

Considering the alternative, perhaps the price increases after you place your bet, and you decide to cut your losses by closing your bet when the quote is 652.1 – 655.1. This time your bet closes at 655.1 from a starting price of 579.5, which is a difference of 75.6 points. 75.6 times £5 is £378, the amount that this losing bet would have cost you.

Many traders decide to use a stop loss order to help minimize their losses. The stoploss order requires your spread betting company to close your bet if it reaches a certain level of loss, whether or not you are online or even aware of the situation. Perhaps with a stoploss order your bet would have closed earlier when the quote was 636.3 – 639.3. In this case your starting price was 579.5 as before, and your closing price was 639.3. 639.3 minus 579.5 is 59.8 points. By using the stoploss order you would have lost less, as with a bet of £5 per point this amounts to £299.

Ophir Energy Futures Based Spread Bet

As a young company with a volatile share price, Ophir Energy is a risky proposition to expect to hold for the longer-term trade; but suppose you want to place a futures based long bet for the far quarter at £3 per point, and the current price for this is 581.3 – 588.3. It is worth noting that with a futures style bet, you are still at liberty to close the trade whenever you want to, even the next day, if you feel you have made sufficient profit or want to prevent further loss with a losing trade.

If the volatility works in your favour, you might find that you are able to close this spread bet for a win when the price is 652.7 – 659.3. Working out the number of points that you gained on your bet, 652.7 minus 588.3 is 64.4. You staked £3 per point, so your profit is £193.20.

It is quite likely that your bet will not succeed, and you must be prepared for your share of losing trades. Perhaps the price would drop to 539.2 – 545.8, and you decide to close your trade and cut your losses. The difference between the opening price of 588.3 and the losing price of 539.2, 49.1 points, now counts against you, so multiplying by your wager size of £3, you would find that you have lost £147.30.

Another way to exit a losing bet is to have a stoploss order, which is normally placed when you open the bet. Now a losing bet will be closed even if you do not do anything else, as your spread betting provider will take care of it. With a stop loss order, you might find that your losing bet closed earlier, at 552.9 – 555.3. Working out your loss this time, 588.3-552.9 is 35.4 points, which for your chosen size of stake amounts to £106.20.