Another important technique in technical analysis is use of the relative strength index or RSI. This is most useful when betting on the performance of indexes or individual shares and involves comparing an index to past performance or comparing a company’s share price to the relevant section of the stock market or against its competitors. RSI indicates whether a market is overbought, ie. there are too many investors holding shares, in which case the market is likely to fall. Or, whether it is oversold, ie. there are too few investors holding shares, more will purchase, and that the market will rise as a result.

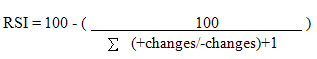

The RSI is based on the ratio between previous price increases over previous price decreases. For the mathematically minded it is as follows :

If you are not mathematically minded, here is how to calculate RSI :

The data you need to calculate RSI is the change in closing prices of the stock or index you are looking at. For example, if a market closed at 3065 one day, 3083 the next and 3024 the next, the changes would be, respectively, +18 and -59. You can use any number of days for your sample as long as it is the same for all parts of the calculation. Seven days is a convenient sample.

Next, add together the sum of the positive changes and the sum of all the negative charges. This will give you two figures.

Now divide the total of the positive changes by the total of the negative changes, add one, and divide that figure into 100.

Finally, subtract the figure you have just obtained from 100. This gives you the RSI figure for the final day of your calculations. To obtain the RSI for every subsequent day simply repeat the same calculation for the same preceding number of days.

Once you have the RSI you might make the following conclusions :

- RSI figures above 70 tend to indicate that the market is overbought and a fall in prices can be expected.

- RSI figures below 30 tend to indicate that the market is oversold and a rise in share prices can be expected.

You need to know that these break points are not exact. Some experts regard the boundaries as 80 and 20, or similar figures. Experience will help you become more accurate.

You can make a very simplified judgement of relative strength simply by comparing the price of certain shares with those of similar companies, or the price of one market or index with similar ones in other countries. If all of them have fallen or risen this is a trend which is likely to continue. However, if the price of just one is outperforming or underperforming the others then it is likely that this situation will continue and that, in the short term at least, this individual share, market or index will rise or fall even faster in the future.