Placing a spread bet is a relatively simple and easy process. The following 5-step guide by City Index shows how you can place your first few spread bets.

- Pick a market and take a view

It is important that you pick a market you know. We recommend that you take your time to understand the amount of price volatility associated with that market, before you start trading, as this will help you to attain a better understanding of the likely result of any trade on that market. For example, if you want to trade Company ABC, and its share price moves 2p on average each day, then you can assume there is likely to be a minimum 2p risk for each day your trade remains open.

It also helps to learn about factors that are likely to influence prices for the intended lifetime of your trade, such as company earnings announcements or economic data. For example, rising oil costs often negatively impact the share price of airlines (as rising fuel costs would cause profits to fall, thus pulling down the airline’s share price) and so on.

Once you have picked your market and taken a view, it’s now time to place your trade.

- Choose your trade and stake size

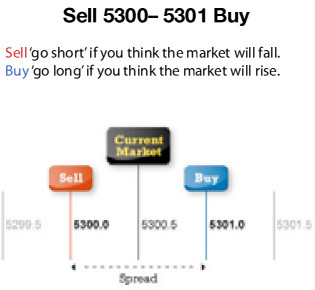

Once you have picked a market that you are comfortable with, you need to request a price. Each market details bid (sell) and offer (buy) prices, with the difference between the two known as the ‘spread’.

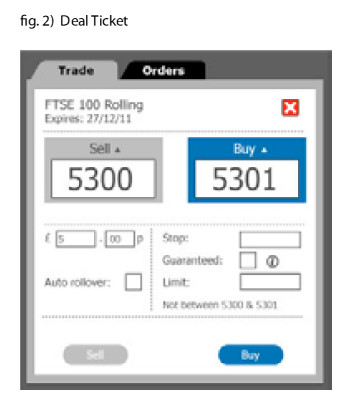

For this example we will use the FTSE daily rolling spread as our trade example.

If you believed that prices would rise, you’d ‘buy’ or go long on the buy price of 5301 and your profits would rise in line with any increase on that price. If you believed that prices would fall, youwould sell or go short on the sell price, and your profits would rise in line with any fall in price.

Your stake size is the amount of money you want to risk per point movement in price.

So let’s say you decide that the FTSE 100 will rise in value and BUY £5 per point at the buy price of 5301.

This means that for every point the FTSE moves higher, you will make £5. Consequently, for each point the FTSE moves below 5301, you lose £5.

FTSE Daily Rolling Example

If you believed that prices would rise, you’d ‘buy’ or go long on the buy price of 5301 and your profits would rise in line with any increase on that price. If you believed that prices would fall, you would sell or go short on the sell price, and your profits would rise in line with any fall in price.

Your stake size is the amount of money you want to risk per point movement in price.

So let’s say you decide that the FTSE 100 will rise in value and BUY £5 per point at the buy price of 5301.

This means that for every point the FTSE moves higher, you will make £5. Consequently, for each point the FTSE moves below 5301, you lose £5.

- Financial health check

Spread betting is a leveraged product. This means that you are only required to initially deposit a small fraction of the total exposure to place a trade.

It is important therefore that you make sure you have enough funds to place the trade. For the FTSE 100 Daily Rolling spread bet, we offer a margin rate of 60 x stake. This means that you need to have a minimum of £300 (60 x £5 = £300) in your spread betting account in order to place the trade.

It is also equally important that you have enough funds in your account to help cover any likely price moves for the duration of your trade. For example, if the FTSE 100 moves an average 50 points a day and you are likely to keep this trade open for two days, it could be wise to have an additional £500 at least (50 x 2 x £5) in your account to help cover any potential negative price swings against you.

- Add Closing Orders

You can use the order system to both manage your trades and minimise your risk, even when you are not in front of your trading screen.

An order is an instruction to trade at a point in the future when prices reach a specific level predetermined by you.

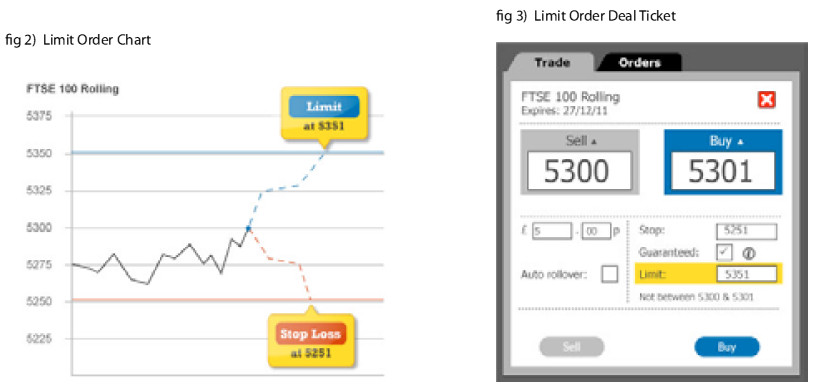

There are two types of closing orders Stop Loss and Limit Order.

Stop loss and Limit Orders are designed to maximise your ability to manage your trades, even when you are not in front of your trading screen.

You can utilise closing orders to help ensure that you lock in your profits and minimise your risk when your respective profit and risk targets are reached.

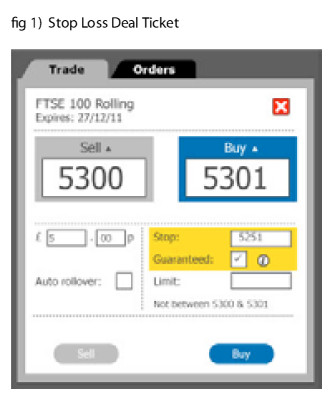

A Stop Loss Order is an instruction to close out a trade at a price worse than the current market level and, as the name suggests, is used to help minimise losses.

There are two types of Stop Loss orders- standard and guaranteed. A standard stop loss order, once triggered, closes the trade at the best available price. There is a small risk therefore that the closing price could be different from the order level if market prices gap. A guaranteed stop loss however, to which a

small fee is charged, guarantees to close your trade at the stop loss level you have determined, regardless of any market gapping.

In our FTSE Daily Rolling trade example, we placed a BUY £5 per point trade at 5301. If we place a guaranteed stop loss order at the 5251 level, this means that our trade will automatically close should the FTSE fall to 5251, capping any losses at £250 (5301-5251 x £5). To guarantee the stop loss level on this FTSE trade, there is a charge of £15 (3 x stake size i.e. £5).

Tip: The only way to 100% limit your spread betting risk is to use a guaranteed stop loss.

A Limit Order is an instruction to close out a trade at a price that is better than the current market level and is used to help lock in profit targets.

In this FTSE Daily Rolling example, if we place a Limit Order to lock in profits at 5351, this will mean that should the FTSE rally as we expect, as soon as prices hit the 5351 level, which would mean a profit of £250 (5351-5301 x £5), your trade will automatically close and the £250 profit will immediately be transferred into your cash balance.

- Closing the Trade

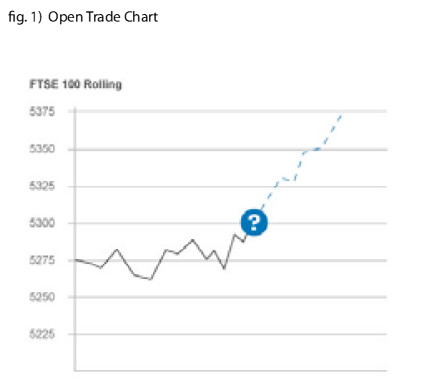

Having placed your trade and closing orders, your open profit and loss will now fluctuate in tandem with each move in the market price.

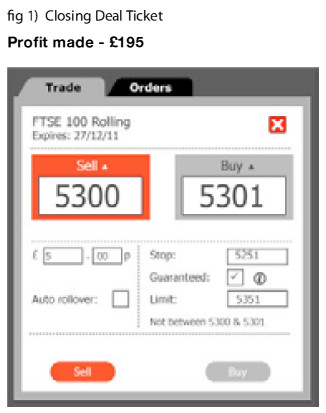

When you are ready to close your trade, you simply need to do the opposite to opening a trade. So say you placed a BUY £5 FTSE Rolling trade to open. You now need to SELL £5 FTSE Rolling at the current sell price to close the trade.

By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance.

Using the same trade example, let’s say that the FTSE 100 had rallied as you had expected, to trade at 5340. Whilst the rally was not enough to hit your Limit Order profit target of 5351, you decided that it was enough to net you a tidy profit of £195 (5340-5301 x £5). By placing a new SELL £5 FTSE Rolling trade at 5340, your FTSE trade would fully close and your open profit of £195 would immediately be reflected in your cash balance.